Feed-In Tariffs

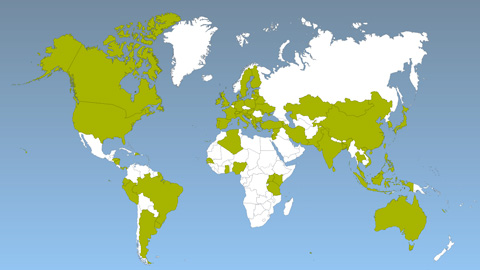

Feed-in tariffs (FITs), along with renewable electricity standards, are one of the most widely adopted renewable energy support policies around the world. As of 2013, 98 national and subnational governments had implemented FITs, nearly three times the number that had adopted them in 2004 (ren21.net). In recent years, FIT activity has focused primarily on revisions to current policies, underscoring the need for stable and predictable, yet flexible, policy environments. This policy brief provides a primer on key FIT design elements, lessons from country experience, and support resources to enable more detailed and country-specific FIT policy design.

A feed-in tariff is a performance-based incentive that can includes multiple policy elements: a fixed per kWh price for electricity, an electricity purchase guarantee, guaranteed interconnection, and standard power purchase contracts (Huenteler 2014). Feed-in tariffs are one of the most commonly implemented policies to support renewable energy deployment, and by early2015, FITs were implemented at the national or state levels in 108 countries (REN21 2015, UNFCCC 2015), with half of all feed-in tariffs enacted in developing countries (Huenteler 2014). Through guaranteed long-term fixed renewable electricity prices, FITs support increased investor confidence and expanded RE deployment (Couture et al. 2015, Fulton et al. 2009; DB Climate Change Advisors.

FITs have evolved over time from reliance on strict fixed, long-term prices to more innovative models that better enable participation in liberalized electricity markets, such as premium FITs, market premiums, and contracts for differences. (Couture et al. 2015) However, given that feed-in premiums lead to less revenue certainty, the cost of capital for project finance under a premium scheme may be higher than under a fixed FIT scheme. (CPI 2013) In liberalized electricity markets, FITs can result in the de facto creation of a separate market for renewable generators. In these markets, guaranteed long-term contracts are provided for renewable energy generators, whereas conventional generators continue to compete on the spot market (Couture et al. 2015). Historically, FIT prices were set higher than retail electricity prices to spur investment. However, for several locations and technologies (especially for PV in Europe and islands), on-site generation now costs less than electricity purchased from the grid. As a result, and with support from complementary policies (such as bonuses for on-site consumption), more end users have installed PV systems for their own use (Couture et al. 2015).

Design Elements and Good Practices

Setting and Revising FIT Payment Levels

To align with specific policy goals, policymakers can vary FIT payments by technology, project size, location and/or resource quality. Specific approaches are noted in the text box on this page. In each case, project developers need to be assured a revenue stream at a predictable payment and terms to ensure a reasonable profit for the project.

To support scaled-up deployment and innovation, FIT payments for new projects should also be adjusted incrementally as technology costs change (nrel.gov). However, payment changes should be made transparently and predictably, as erratic adjustments may increase project developer uncertainty and reduce investment (In 2013, most adjustments to FITs were a reduction in the tariff to adjust for changes in the market (REN21 2015).). Policymakers may choose to address this challenge by establishing periodic FIT review periods or setting a pre-established percentage or level of capacity installed for annual declines in the FIT payment, as well as less frequent broader policy revisions (e.g., every 3–5 years). Payment adjustments can be informed by collecting detailed data related to technology market evolution and prices. Supporting a stable and predictable policy environment that is also flexible and iterative is critical for positive outcomes (nrel.gov).

Setting the payment level is the most complex element of the FIT design process and requires robust analysis to balance cost recovery with avoiding excessive developer profits (nrel.gov). Payments can be either dependent on or separate from the market price for electricity. A premium-price FIT combines the electricity market price and a premium (either stable for the life of the contract or designed to fluctuate), thus adding a degree of uncertainty for the developer due to varying market prices. A fixed-price FIT provides the same payment for the duration of the contract, which, although it is simpler, can result in excessive developer profits if electricity prices increase substantially (nrel.gov). Ultimately, policy costs can be integrated with the electricity rate base (nrel.gov).

Considering a Cost Containment Approach

If the FIT payment rate is set to be higher than the utility avoided cost, it may incur additional costs which will need to be recovered (e.g. from ratepayers). In order to limit these costs, policymakers may choose to place caps on project participation. However, it is important to recognize that cost containment options could introduce additional market uncertainty and inhibit investments. Cost containment options include:

- Establishing a maximum installed capacity that will be supported (e.g., 200 megawatts per year)

- Reducing the FIT payments on a set schedule when capacity goals are met (e.g., one payment for the first 200 megawatts installed and another payment for the next 200 megawatts installed)

- Ending the FIT when the available program funds have been exhausted.

Guaranteeing Grid Access

Many FITs are also coupled with guaranteed access to the grid. Guaranteed access can help to ensure electricity generated under the FIT is not stranded and is a protection for invested public funds (Couture et al. 2010).

Considering Forecasting Requirements

Under a FIT policy—and to support grid operators in balancing renewable energy generation with system demand—project developers can be required to provide project forecasts. This can be burdensome, especially for smaller plants, but it can be useful particularly for larger renewable energy projects (Couture et al. 2010).

Streamlining Administration and Approvals

To avoid bottlenecks and reduce the time and costs associated with approvals and administration, policymakers can establish a streamlined FIT processing approach that clearly identifies participating entities (e.g., individuals, corporations, nonprofits and government) and mandates specific roles and procedures (Couture et al. 2010).

Considering Linkages with Other Policies

In some markets, policymakers are considering links between FITs and other support policies, such as tender and auction processes. For example, FITs and auctions can be coupled in relation to project size, with FITs supporting smaller projects and auctions supporting larger projects. As RE markets evolve differently in various country contexts, policymakers can consider links between FITs and other policies that may enhance deployment opportunities (Couture et al. 2010). Further information on emerging hybrid designs can be accessed in this report: The Next Generation of Renewable Energy Policy.

Considering FITs in the Context of High Renewable Energy Penetration Levels

As a number of countries and jurisdictions reach high levels of renewable energy penetration, they are adapting FITs to address new needs and opportunities (High RE penetration can be defined as at least 15% of annual electricity generation from RE. (Miller et al. 2013). For instance, FITs can be used to enhance grid support services through incorporating frequency and voltage support incentives. To contain costs, FITs can also be designed to allow transmission system operators to curtail wind while still compensating for the renewable energy generated. Finally, integrating FIT-supported RE generation into centralized markets can also allow for greater efficiency of the dispatch system. Under this approach, renewable energy generation can be bid into day-ahead and intra-day markets, which can allow for optimized generation. In high penetration contexts, linking FITs to wholesale market prices can also increase efficiency of policy outcomes and decrease costs (IEA 2013, nrel.gov).

Establishing Long-term Contracts and Guaranteeing Grid Access

In addition to setting the payment level, it is important to define the length of contracts. Under existing FITs, contract lengths typically range from 10 to 25 years, with longer contracts often resulting in lower cost of financing. Many FITs are also coupled with guaranteed access to the grid. Guaranteed access can help to ensure electricity generated under the FIT is not stranded and is a protection for invested public funds (Couture et al. 2010).

Conclusion

FITs are an important policy tool supporting global deployment of renewable energy technologies. Innovative policies building on the FIT approach, such as reverse auctions, offer significant potential for accelerating renewable energy expansion (Couture et al. 2015). The key FIT design elements described in this brief provide a starting point for considering a country-specific and tailored policy approach to support deployment of renewable energy in various country contexts.

See Also

Featured Cases

- Ghana: Sending Consistent FIT Policy Signals

- Indonesia: Designing FITs to Align with Specific Subnational Circumstances and Development Goals

- South Africa: Designing Data-supported, Two-stage Tender Processes to Ensure Project Viability and Successful Policy Outcomes

FITs in Place

For a list of countries with FIT policies in place, see the REN21 Renewables Interactive Map.

Tags and Related Instruments

References and Additional Resources

References

Couture, T., Cory, K., Kreycik, C., Williams, E. 2010. “A Policymaker’s Guide to Feed-In Tariff Policy Design.” Golden, CO: National Renewable Energy Laboratory.

Couture, Toby D., David Jacobs, Wilson Rickerson, and Victoria Healey. 2015. “The Next Generation of Renewable Electricity Policy: How Rapid Change is Breaking Down Conventional Policy Categories.” Golden, CO: National Renewable Energy Laboratory.

DB Climate Change Advisors, Deutsch Bank Group. 2009. “Paying for Renewable Energy: TLC at the Right Price.” Germany.

Huenteler, J. 2014. “International Support for Feed-in Tariffs in Developing Countries.” Renewable and Sustainable Energy Reviews.

Miller, M., L. Bird, J. Cochran, M. Milligan, M. Bazilian, E. Denny, J. Dillon, J. Bialek, M. O’Malley, and K. Neuhoff. 2013. “RES-E-NEXT: Next Generation of RES-E Policy Instruments.”

Miller, Mackay, and Sadie Cox. 2014. “Overview of Variable Renewable Energy Regulatory Issues: A Clean Energy Regulators Initiative Report.”

Nelson, D. and Brendan Pierpont. 2013. “The Challenge of Institutional Investment in Renewable Energy.” San Francisco, CA: Climate Policy Initiative.

Philibert, Cédric. 2011. “Solar Energy Perspectives.” Paris: International Energy Agency.

UNFCCC Secretariat. 2015. “Updated Compilation of Information on Mitigation Benefits of Actions, Initiatives and Options to Enhance Mitigation Ambition: Renewable Energy Addendum.” Bonn, Germany: UNFCCC.

Additional Resources

IRENA Cost Database and the Global Atlas for Renewable Energy.

KPMG International. 2013. “Taxes and Incentives for Renewable Energy.”

Ming-Zhi Gao, A. 2014. “A More Sustainable Way to Promote PV: Transformations from FIT to FIT/FIT Tendering Schemes in Taiwan and France. Legal Issues of Renewable Energy in the Asia Region: Recent Development in a Post-Fukushima and Post-Kyoto Protocol Era.” The Netherlands, Kluwer Law International: 38.

Rickerson, W., Uppal, J., Glassmire, J., Lilienthal, P., Sanders, E., Colson, C., Couture, T., et al. 2012. “Renewable Energies for Remote Areas and Islands (REMOTE).” Paris, France: International Energy Agency Renewable Energy Technology Deployment (IEA-RETD).

Trabish, H. 2014. “Solar’s Faceoff: Feed in Tariff Versus Net Energy Metering." The EnergyCollective.com.

See also FIT Payment Level Approaches and FIT Support Resources